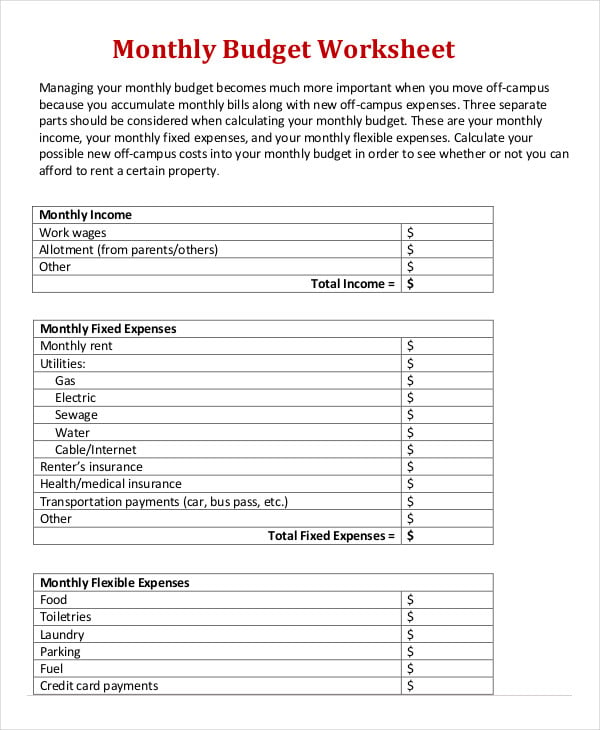

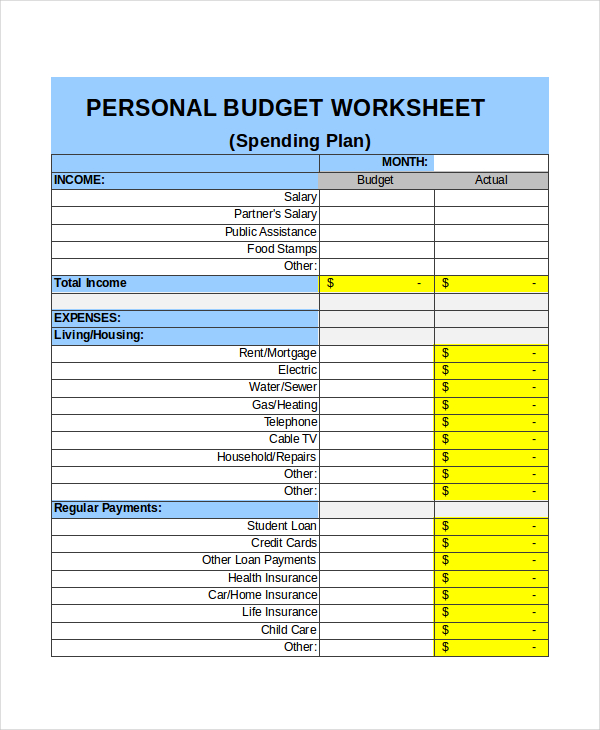

Budget categoriesīudget Categories, when properly implemented, help you to achieve your financial goals. Making your monthly budget account for each necessity, under a category like utilities, and each discretionary purchase, under a category like personal care, helps you to manage your spending. Ineffective budgets often don’t have enough categories, and therefore, money just “goes missing,” or the categories are specific and spending becomes impossible to keep track of. Listing all of your income for a month against all of your spending, either for required or discretionary expenses, will help you see your personal cash flow so you can make better decisions and understand what you can and cannot afford.Ī solid budget accounts for every kind of spending you’ll probably undertake during the month. Seeing your expenses laid out in a budget helps you to find and define spending patterns, overspending, surpluses, and to get an accurate picture of your spending. More than a plan, a budget is also an itemized list. People oftentimes associate the word “budget” with restriction, but budgets don’t have to be restrictive to be effective for you or to help you achieve your goals. A budget’s expenses include required bills like insurance and utilities and discretionary spendings like entertainment or personal care.īudgets can be used to help you achieve a major goal, such as saving for a house, or for smaller goals, like making all of your payments on time. Personal Monthly Budget is a plan that categorizes and allocates income towards expenses, savings, and debts.īudgets are financial plans made to plan for and categorize all of your expenses for a period of time, usually a month, making sure they don’t exceed your sources of income for that time.

Creating a personal monthly budget template can give you the peace of mind that things will be all right in the long run, no matter the current circumstances. While budgets are good for everyone, if you’re one of many that are finding that your financial situation is in dire straights because of an economic recession or a change in your employment, this is the perfect time to start a personal monthly budget and get control of your finances.

Keeping track of income and expenses is a requirement in most households to make sure money stretches from paycheck to paycheck.

0 kommentar(er)

0 kommentar(er)